Student debt solutions that build financial wellness — today and tomorrow.

Candidly is a fully configurable financial wellness platform that addresses student debt, retirement savings, and beyond.

Request a demoTrusted by hundreds of leading employers, financial institutions and record keepers

Tackle the #1 barrier to financial wellness in the workplace and the wallet

Tackle the #1 barrier to financial wellness in the workplace and the wallet

80 million Americans have student debt or are currently planning or paying for college. Candidly cultivates long-term engagement by offering solutions for every user, which can be delivered as an employee benefit, or seamlessly integrated into a partner’s native experience.

From funding to forgiveness - and everything in between

Let's be candid: most people can't afford higher education out-of-pocket. Candidly flips the script on how individuals and families borrow, repay, and save so that college can help them move forward - not hold them back.

Plan

Take smart, practical, and informed actions from the beginning and all along the borrower journey.

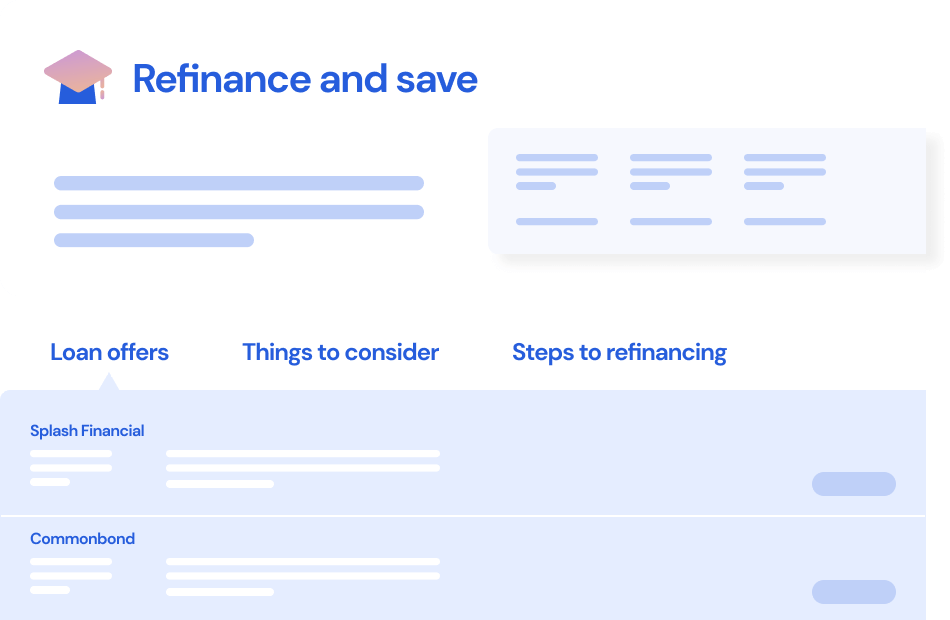

Fund

Tap into a network of trusted lending partners to choose the best-priced option and make informed choices when taking on student debt.

Repay

Optimize your debt repayment strategies to reduce payments, refinance at a lower rate, or accelerate repayment to reduce the overall cost of borrowing.

Build

Save on student loans and take the next best action on those dollars to maximize financial resilience, whether via retirement savings, investments, or a rainy day fund.