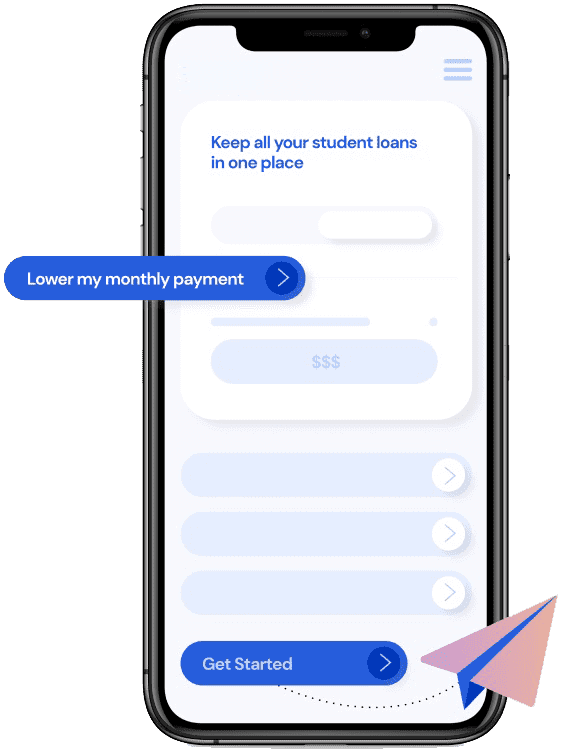

The only solution that manages the full lifecycle of education expenses and financial wellness.

Candidly is an AI-driven student debt and savings optimization platform that delivers personalized, actionable guidance.

Request a demoHow it works

Assess

A personalized path

Candidly continuously evaluates users' financial health, and pairs that with expert guidance and content, to create a personalized plan.

Optimize

Action for today

Candidly guides users to action within minutes to drive immediate savings to their wallet.

Accelerate

Action for tomorrow

Candidly empowers users to take actions today that will lead to a financially sound tomorrow.

Candidly core capabilities

Federal forgiveness finder

College planning

Articles and how-to-guides

Gamified emergency savings

Auto-payments

Student loan dashboard

Gamified repayment

Friends and family

Multi-lender marketplace

Premium capabilities

Student loan contributions

Public service loan forgiveness tools

Student loan retirement match

Expert coaching

Emergency savings contributions

Fully Configurable

Flexible Delivery

Fast-To-Market

One platform, many uses

Salesforce

Obstacle

Financial wellness benefits are a no-brainer in the modern workplace. But offering inclusive financial wellness benefits is easier said than done.

Opportunity

As the second most common form of consumer debt, student debt spans every age, gender, race, income, lifestage, and profession.

Outcome

Salesforce Inc.’s partnership with Candidly has enabled the software giant to:

- Break through to employees across every cohort

- Achieve record impact with historically high-turnover populations: women, people of color, and software engineers

- Empower employees to reduce their student debt balance by over $2.38 million and 151 years

Flexible implementation

Offer our platform where, how, and when you want it, in our brand or yours.

Outlink

Get to market in just days with a co-branded configurable experience.

SSO

Hand off seamlessly from your application to ours.

Widget

Easily drop into your native experience.

API

Maintain full control over the front-end experience.

Seamless experience, meaningful impact

Don't take our word for it

We partner with hundreds of companies to help their employees and customers move beyond student debt and toward a financially sound tomorrow.

Request a demo