For plan sponsors and recordkeepers

Unlock the savings power of a student loan retirement match

Employers can help bridge the gap between paying down debt and saving for retirement. Candidly can get you started today.

Request a demoOperationalize the SECURE Act 2.0

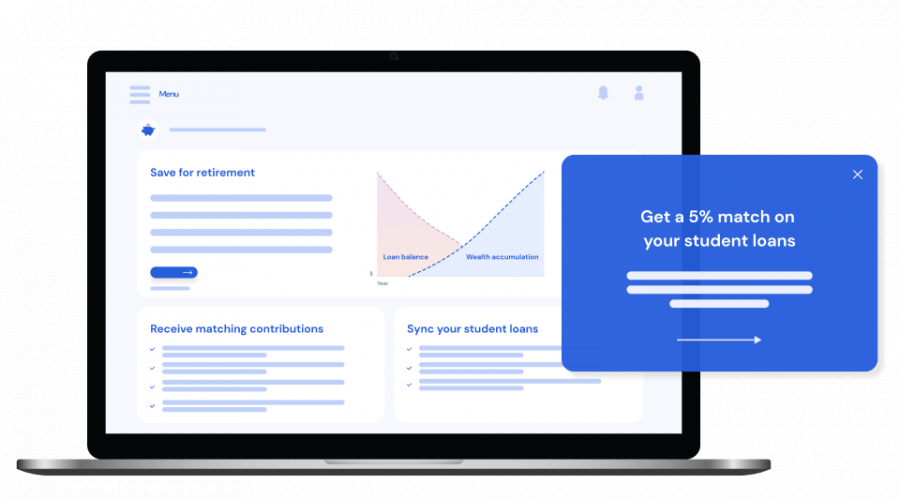

Student loan verification

Our proprietary loan verification widget allows us real-time visibility into student loan accounts to verify payments with industry-leading accuracy.

Match calculations

We support your ability to calculate participants’ match based on their student loan payments and plan sponsor program design.

Our platform — or yours

Modular features allow you to meet every employee with the most relevant solutions.

Zero hassles

Employers can launch in days; employees can onboard in minutes.

Bring retirement goals within reach for everyone with the SECURE Act 2.0

The SECURE Act 2.0 grants tax incentives to match employees’ student debt payments with retirement contributions.

8/10

8 in 10 borrowers say their student debt hinders their ability to save for retirement.

73%

73% of people expect to begin or increase their retirement savings once their student debt is paid off.

25%

25% of people cite student debt as the reason they dont participate in a retirement plan.

Deliver solutions that meet your customers where they are

Candidly’s fully configurable platform delivers student loan retirement match along with a full range of capabilities to optimize student debt and deliver immediate impact to the wallet.

Candidly core capabilities

Federal forgiveness finder

College planning

Articles and how-to-guides

Multi-lender marketplace

Auto-payments

Student loan dashboard

Gamified repayment

Friends and family